| Question | Answer | |

|---|---|---|

| 1 | What SCBT services/businesses will be transferred to TISCO? | Retail Banking Business: personal loans, business loans, mortgage loans, wealth management, bancassurance, retail deposits and credit card |

| 2 | What is the effective date of the transfer? | 1st October 2017 (any change will be advised) |

| 3 | How many SCBT's branches will be transferred to TISCO? Which one? | 5 branches: 1) Thonglor Branch 2) Phahurat Branch 3) Major Ratchayothin Branch 4) Lotus Rama III Branch 5) Lotus Rattanathibet Branch |

| 4 | What should the transferring SCBT clients do? | SCBT's retail clients will receive detailed letter from SCBT by the beginning of July 2017. The clients listed in no.6 should bring documents stated in the letter for transfer account transaction at SCBT's branches from 3 July 2017 - 29 September 2017. TISCO and SCBT staff will jointly service to accommodate the transactions at SCBT branches during 3 months before the effective transfer date. |

| 5 | Which type of clients should contact the Bank before 1 October 2017 |

1) Saving account 2) Fund account 3) Bancassurance account using deposit account for the direct debit of insurance renewal premium or for funds transfer receiving of benefits 4) Mortgage One home loan account 5) Mortgage Link home loan account using deposit account 6) Mortgage Link account that wish to change to Mortgage Saver account 7) Cash Backed Overdraft account 8) Credit cards backed by deposit account 9) Personal loan backed by deposit account 10) Business loan backed by deposit account |

| 6 | What will happen if the clients fail to visit the Bank's branches before 1 October 2017. | Clients will not be able to continue any account transactions until they go to TISCO to complete the account transfer procedures. |

| 7 | Will deposit clients get the same deposit interest rates? | Yes, they will get the same interest rate until further notice of change, if any. |

| 8 | Can SCBT's credit card holders still use the existing card? Will the conditions and benefits remain the same? | Yes. clients can continuously use the existing credit cards until receiving TISCO Card in September 2018. Please refer to detailed conditions and benefits addressed in your SCBT's letter. For more information, please contact 1595. |

| 9 | Where to contact if there are any queries about the transfer or about TISCO products? | SCBT Call Center at 1595 or TISCO Contact Center 02-633-6000 press *7 or ContactCenter@tisco.co.th for 24-hour services |

FAQ about Deposit

| Question | Answer | |

|---|---|---|

| 1 | Will the transferred deposit accounts remain the same type of accounts with the same conditions? | Yes, the accounts will be the same type of accounts except 'Time Deposit Account' will be converted to 'Fixed Savings accounts'. Most conditions will remain the same or become better. The main changes are 'Next Day' domestic fund transaction for the amount of fund not exceed 2 million baht will be replaced with Promptpay money transfers of 200,000 baht and the unlimited free ATM transaction will be replaced with free 10 transactions per month |

| SCBT Deposit Account Types | TISCO Deposit Account Types | |

|

Basic Savings Account Power Saver Savings Account Savings for Fans Savings Account Payroll Plus Savings Account MaxSaver Savings Account JustOne Payroll Savings Account (Special Purpose) |

Basic Savings Account | |

| eSaver Savings Account | mSavings Account | |

| Power Saver Plus Savings Account | Power Savings Plus Savings Account | |

|

Business Saver Savings Account SME Saving Max Savings Account |

Business Savings Max Savings Account | |

| JustOne Payroll Savings Account –Payroll Account | Smart Payroll Savings Account | |

| JustOne Savings Account | One Savings Account | |

|

SME Current Plus Current Account Business Loan Current Account |

Special Current Account | |

| General Current Account | Current Account | |

| Time Deposit Account, all categories and tenors, Time Deposit Book and Time Deposit Receipt (TDR) | Fixed Savings Account | |

| 2 | Will the clients get the same deposit interest rates? | Yes, they will receive the same deposit interest rates until further notice of change |

| 3 | Will the services relating to deposit accounts remain the same? | There will be slightly changes for the services as shown below: |

| SCBT's Services | TISCO Services (New-enrolment Required and will be effective on 2 October 2017 onwards) | |

| ATM/VISA Debit Card Magnetic Stripe Card and Chip Card | ATM/Debit Card – Chip Card Initial fee and first year’s annual fee waived | |

| Online Banking | Mobile Banking | |

| SMS Banking and SMS Alert | SMS Alert | |

| PromptPay | PromptPay | |

| Monthly eStatement Service | Online eStatement Service | |

| Direct Debit | Direct Debit | |

| 4 | Will the clients be able to use services related to deposit accounts at TISCO automatically? | New-enrolment is required at SCBT's branches on transfer account transaction date. The services will be available on 2 October 2017 onwards. |

| 5 | What is TISCO ATM's servicing fee/charge? | No fee for the first 10 transactions per month and 10 Baht fee per transactions from 11th times onwards |

| 6 | Where can I check my deposit accounts balance? | No fee for the first 10 transactions per month and 10 Baht fee per transactions from 11th times onwards |

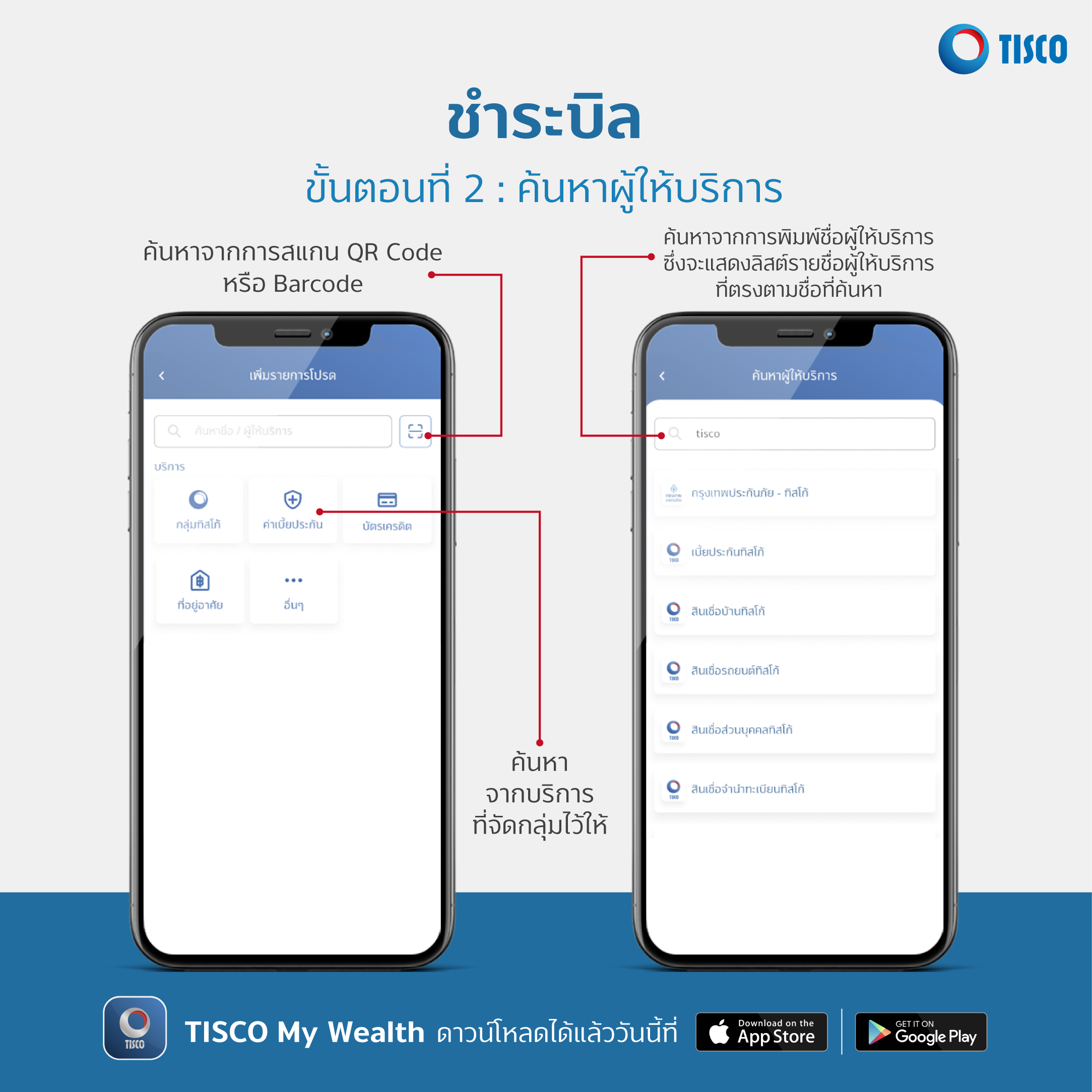

| 7 | Can TISCO Mobile Banking be comparable to SCBT Internet Banking? | TISCO Mobile Banking offers services as follows: 1) Balance inquiry 2) Services for the 5 recent transactions 3) Own account fund transfer/ Other account fund transfer/ Inter-bank fund transfer (same day)/ PromptPay 4) Bill payment/ TISCO loans/ Other merchants * No fund transfer service to international account available |

| 8 | Will SCBT's deposit accounts that linked with direct debit service such as utilities bills be automatically enroll at TISCO? | No, they must do the re-enrolment of direct debit service which will approximately take 2 billing cycles. If the clients fail to do the transfer procedures, the direct debit services will be automatically cancelled. |

| 9 | Will Priority Banking clients be offered the same privileges and benefits? | Priority Banking clients will be assisted by TISCO relationship managers who will give financial and investment advices The clients will enjoy the products, services, privileges and other banking solutions that TISCO has been offering to their Wealth clients |

| 10 | Where can I request for Certified bank statement/ Withholding tax certification/ Deposit interest certification (after the effective transfer date) | Please contact SCBT for the documents for the balance before 1 October 2017 and contact TISCO for the documents for the transferred balance after 1 October 2017 |

Depository Services

Savings Accounts

Current Accounts

Fixed Deposit Accounts